Transaction data is the key to providing your customers with valuable insights that can help them improve their financial wellbeing, and help your business make better decisions. However, transaction data can often be confusing for customers as well as expensive and time consuming for banks to resolve queries and glean insights from. Experian research revealed that 73% of Australian and New Zealand digital banking customers experience issues recognising transactions in their bank’s app.

Searched business name

40% had to look up a business name online to find out what it was.

Called to query a transaction

32% called their bank to query a transaction.

Called to confirm accuracy

28% had to call their bank to confirm the accuracy of transaction records.

Requested a chargeback

17% requested a chargeback for a transaction they didn't recognise in their statement.

Enter transaction enrichment

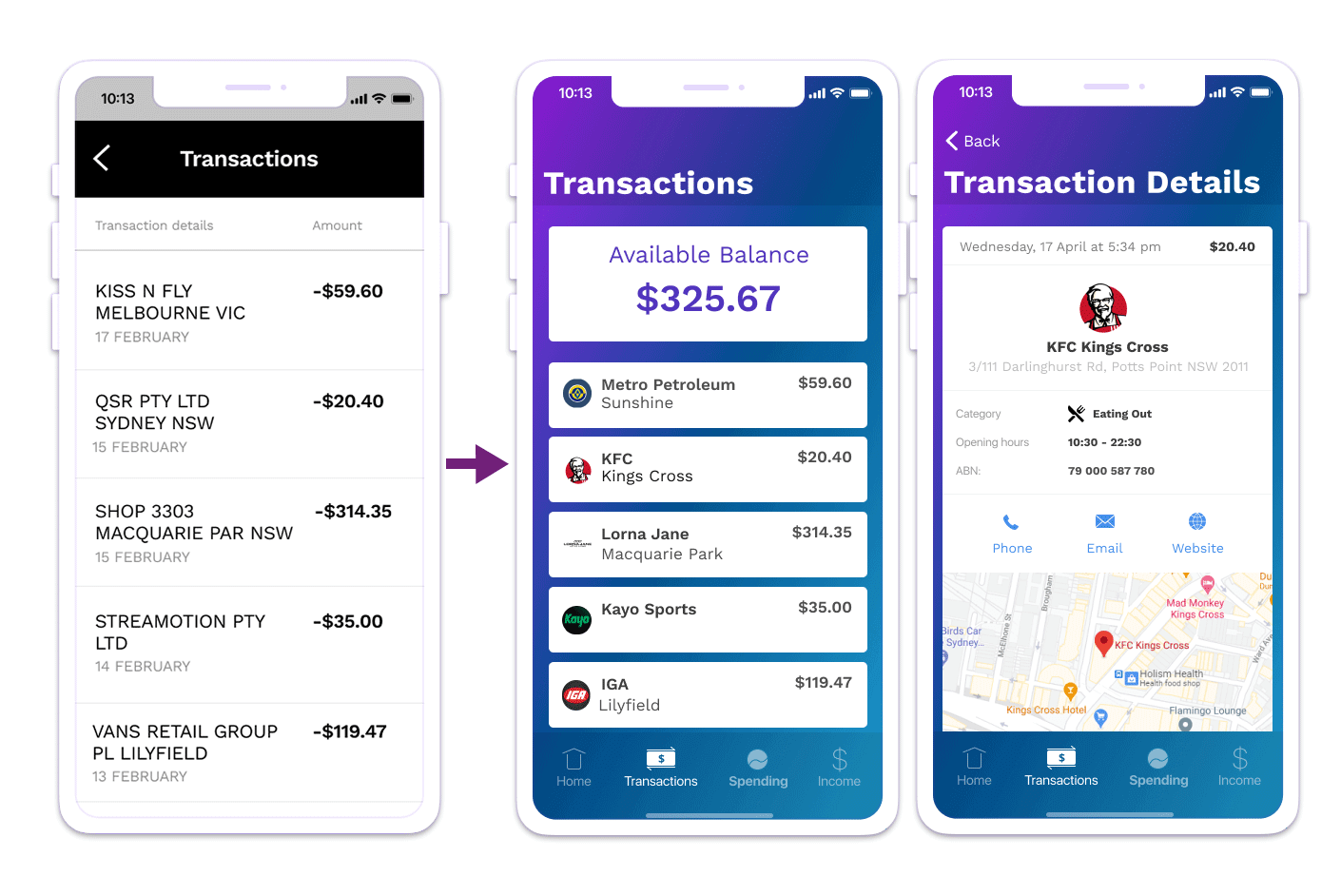

The deceptively simple solution is Experian Transaction Enrichment.

Using our super fast API, you can transform the customer experience while at the same time, significantly reduce costs through lower volumes of calls and chargebacks.

Watch our short video to learn more about how Transaction Enrichment can help you and your customers.

Transform the digital banking experience

Provide your customers with instant clarity on what, where and how much they’re spending in real-time with our multi award-winning transaction data enrichment solution.

Trusted by more than 30 banks and fintechs in Australia and expanded to New Zealand, our solution provides high quality data in real-time, so you can truly understand bank statement data fast.

Step 1

You send Experian your transaction data.

Step 2

Experian’s API takes that transaction data and maps it to our merchant details such as company trading name, logo, map, contact details, category etc.

Step 3

Experian returns to you clean, enriched and actionable data in mere milliseconds for more valuable insights.

Improve the customer experience

Instant clarity on what, where and how much your customers are spending in real-time.

Real-time transaction notifications

You can enable meaningful real-time transaction alerts for your customers to help them stay on track.

Comprehensive data

Leverage a comprehensive dataset of over 100m New Zealand transactions and growing, linked to a detailed database of merchants.

Reduce call centre traffic

Call centre traffic due to “transaction not recognised” queries may be reduced by up to 50%.

Reduce chargebacks

Chargebacks due to “transaction not recognised” queries may be reduced by up to 25%.

Easy implementation

API driven so the solution can be seamlessly integrated with your existing digital applications.

I’d like to learn more

I’d like to get started

I’m already an existing user

By providing your personal information you agree that we may collect, hold and use it in accordance with our Privacy policy and Terms and conditions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.